Bitcoin and Cryptocurrency: Methods for Storing and Distribution

| ✓ Paper Type: Free Assignment | ✓ Study Level: University / Undergraduate |

| ✓ Wordcount: 7017 words | ✓ Published: 06 Jun 2019 |

Glossary:

- Block house = A brokerage firm with the primary focus of locating potential buyers and sellers of large trades. A block house typically deals with institutional clients rather than individual investors, since each transaction represents millions of dollars.

- Block trade = A large lot of stocks or bonds traded in a single transaction. A securities transaction of at least 10,000 shares or a bond transaction of at least $500,000 is considered a block trade.

- The Financial Crimes Enforcement Network (FinCEN) = is a bureau of the United States Department of the Treasury that collects and analyzes information about financial transactions in order to combat domestic and international money laundering, terrorist financing, and other financial crimes.

- The Financial Conduct Authority (FCA) = is a financial regulatory body in the United Kingdom, but operates independently of the UK government, and is financed by charging fees to members of the financial services industry.

- The Internal Revenue Service (IRS) = is the revenue service of the United States federal government. The government agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue, who is appointed for a five year term by the President of the United States.

- Overstock.com, Inc. = is an American internet retailer headquartered in Midvale, Utah, near Salt Lake City. Patrick M. Byrne founded the company in 1997 and launched the company in May 1999.

- Paper wallet = Paper wallet is a document containing all of the data necessary to generate any number of cryptocurrency private keys, forming a wallet of keys. It also includes paper keys and redeemable codes.

- Cryptographic = mathematical algorithm, used in conjunction with a secret key, that transforms original input into a form that is unintelligible without special knowledge of the secret information and the algorithm. Such algorithms are also the basis for digital signatures and key exchange.

- Blockchain = A block chain is a transaction database shared by all nodes participating in a system based on the Bitcoin protocol

- Exchange site = A cryptocurrency exchange site is a place where users can open up a cryptocurrency web wallet and hold their own cryptocurrency with access from wherever. They are among the most popular wallets due to this fact, but also because of the main reason that they were created – To buy and sell cryptocurrencies. The value of the coins update in real time.

- Hot Wallet = A hot wallet refers to a Bitcoin wallet that is online and connected in some way to the Internet.

- Cold storage = Cold storage in the context of Bitcoin refers to keeping a reserve of Bitcoins offline.

- Cryptocurrency = a kind of digital currency which is secure by cryptography technology. The creation of additional units of the cryptocurrency is controlled by the computer system instead of government, and this avoids the inflation problem and the price is decided by its users.

- Decentralization = the process of redistributing administrative power from a single place to several smaller ones. When this term used in cryptocurrency market, which means the currency is no longer issued only by government and everyone can mine cryptocurrency in order to contribute to the market.

- Mining = when this term used in cryptocurrency market, this means miner can use their own personal computer to solve complex mathematical equations on the online cryptocurrency network in order to get cryptocurency rewards.

1. What exactly is a cryptocurrency?

Cryptocurrency is a decentralized digital currency without government, organization or physical support. Its value is decided by people (that is not different to the way people current fiat currencies work). There are three examples of cryptocurrencies are Bitcoin, Ether and Litecoin.

Cryptocurrency means money that is made hidden and private—and therefore secure—by means of encryption, or coding. All aspects of the cryptocurrency are protected by long and complex code blocks, each one is unique to the thing or person that you protect. As for investors, or someone who is involved in a transaction identified by a unique code of its kind, since it is the person or company with whom you are doing business. Each “coin” of the same cryptocurrency has its own code and smaller denominations have their own as well, depending on how much is required for a transaction. Finally, the transaction identifies itself with its own code. Layer on layer of encryption is one of the things that makes the cryptocurrency distinct, secure, and anonymized, if desired. And all the coding and secretion is what makes the cryptocurrency its real name.

2. How does the technology underlying a cryptocurrency system, called blockchain technology work?

Blockchain and cryptocurrency: the technology and application

Block chain is a technology that gets hotter with bitcoin. Bitcoin, as a cryptocurrency, must solve the problem of trust in order to have value that can be transmitted. Past trust has been achieved through a centralized scheme that uses either a company or government credit as an endorsement to place all of the value transfer calculations on a central server. The founder of bitcoin, Ben Hua provides a decentralized solution through distributed books, namely block chaining.

In this system, public ledger recorded the currency ownership, and recognized by encryption protocol and mining community. Their characteristic are decentralized, distrust, distributed, tamper-resistant, encryption etc. It is because of the BlockChain is a good solution to the digital currency in the “double” and “Byzantine Generals” problem, digital currency bitcoin represented in a certain range of rapid development.

BlockChain technology not only apply in cryptocurrency but also other areas.

3. What is a block house and block trade and how is it utilized

An intermediary firm that pay attention on finding potential buyers and sellers of major trades. In general, a blockhouse[1] usually prefer to deals with institutional clients than individual investors, because each transaction represents a large amount – millions of dollars. Institutional clients for example include mutual funds and pension funds, which have important security positions. Due to the nature of the blockhouse companies, their trading activity can have a significant impact on the financial markets. Block trades are usually those that have more than 10,000 shares (without penny shares), or any other trade that involves a high monetary value.

A block trade[2], which also called block order, and usually involves a significantly large amount of stocks or bonds being traded between two parties, usually outside of the open markets at an arranged price, to reduce the impact on the security price. It is an order or trade submitted for the sale or buy of a large amount of securities. Typically, at least 10,000 shares of equities, not including penny stocks, or $200,000 worth of bonds are considered a block trade.

Block trades are conducted through Block house as they are specialize in large trades knowing how to carefully initiate such trades, in order not to trigger a volatile up or down in the price of the security. Block houses keep traders on staff who are proficient in managing trades of that size. Staffers offer a block house to allow the company to trade these large amounts more easily in special relationships with other traders and other firms.

While a large institution consider to start a block trade, it will believe the staff of a block house will help getting the best deal corporately and reach out to them. If the order is arranged, the brokers at a block house will touch other brokers, particular in that precise type of security being traded, and the master securities trader fit the larger order through each sellers.

4. Explain the different methods in which cryptocurrency can be acquired?

There are several different methods to acquire cryptocurrency, such as do cryptocurrency transactions, accept it as payments, and mine it by solving questions.

- Purchasing cryptocurrency[3]

Users can purchase cryptocurrency by using cash through cryptocurrency exchange sites, forums, online communities, or friends. And then deposit cryptocurrency right into user’s secured digital wallets.

Cryptocurrency exchange site is the most secure, fast, and popular used method for users to buy cryptocurrency and users just need to pay little amount of transaction fee to exchange sites.

Another way to buy cryptocurrency is through the online communities which members are having same interest in cryptocurrency. Buyer and seller can discuss about the trade details such as price, amount, and payment by themselves. However, there are some buyers cannot get cryptocurrency after they send money to seller. Therefore, it is important to do trades only with user who has good reputations to previous trades.

- Accepting cryptocurrency as payments[4]

Accepting cryptocurrency as payments for services or merchandises is the easiest way to get into cryptocurrency market. Users just need to give their customers the option to pay in cryptocurrency and open up a cryptocurrency merchant account which allows customers to send order requirements.

- Mining cryptocurrency[5]

Mining cryptocurrency requires an investment in powerful hardware and specialized software. Miner can use their own personal computer to solves complex mathematical equations on the online cryptocurrency network in order to get cryptocurency rewards. However, there are more and more people participate in cryptocurrency mining, which required miners to upgrade their hardware and software in order to gain coins in the intense mining competition.

5. What are the different methods in which cryptocurrency can be stored, after being acquired?

User needs to open up a specific secure digital wallet at the very first step. These digital wallets are designed to store, send, and receive cryptocurrency. There are mainly divided into five options to hold any sort of cryptocurrency. The different methods of storage come with different levels of security and access. User can use a web wallet, software wallet, mobile wallet, universal wallet, or hardware wallet.[6]

- Web wallets

Web wallet is as known as online wallet which is the most commonly used wallet for users who trade a lot. This wallet is easy to access and several software setup procedures can be omitted. Usually, the web wallets are offered by cryptocurrency exchange site. Users can do the cryptocurrency transaction on the exchange site and deposit directly into their web wallet account. And users just need to pay little amount of transaction fee to the exchange site. The reason that web wallet became the most popular used type of wallet is because of the easy transfer and sell options, easy to purchase different cryptocurrencies on these sites all the time, all over the world.

However, there were several cases of hacker attacks to these exchange sites and which carried out great lost and hit exchange rate. The disadvantage of web wallets is that there is always vulnerable to hacker because web wallets constantly connected to the internet.[7]

- Software wallets

Software wallet, also called desktop wallets, is an app that implemented on user’s computer. Users can only access their cryptocurrency from their own computer. This kind of wallet does not store user’s private keys on its servers which means the key information of user’s cryptocurrency data are protected.

Despite software wallets let its users control over their cryptocurrency completely, it limits user in terms of using cryptocurrency. Users have to open and download several different wallets software for each cryptocurrency. And they will also have to be on their computer when they need to do transaction.

- Mobile wallets

By using mobile wallets, users need to download application on smartphone which is used with internet connection. Usually, it used to do small amount payments in online and physical stores for merchandise. Users will not deposit large portion of their cryptocurrency in mobile wallets due to its high potential risks of having hacker attacks.

- Universal wallets

Universal wallet is the combination of software wallets and mobile wallets which provide multiple platforms for users. Users can use only one wallet across multiple devices.

- Hardware wallets

Hardware wallet is the most secure cryptocurrency wallet which has a secure drive that is kept off-line but has the ability to be plugged into a computer when needed. Hardware wallets are safe because no one can access user’s cryptocurrency without having the drive and when user makes a transaction, they will ask user to confirm each code by pressing a button on the device. Hardware wallets are hacker-proof wallet system.

6. How can cryptocurrency be used in transactions?

Cryptocurrency can be used to purchase just about anything you can image. There are some third party payment processors such as Coinbase and BitPay have helped merchants by taking on the volatility risk in accepting cryptocurrency payments.[8]

- Online stores

Some online stores such as Overstock and Rakuten started to accept cryptocurrency as payments. Users can buy almost everything, from everyday item to luxury items, with cryptocurrency at these online stores.

- Gift cards[9]

Cryptocurrency is a new payment system, it is not mature enough and cannot be accept by lots people. Therefore, most of the retailers still do not have cryptocurrency payment option for customer. However, an electronic gift card retailer, Gyft, solve the weakness of cryptocurrency payments. Gyft accept cryptocurrency payments and customer could buy gift cards for Amazon, Best Buy, Whole Foods, and Walmart.

- Peer-to-Peer transactions

Cryptocurrency users are able to do transactions in a decentralized marketplace. Users can do transactions for expensive items such as real estate, sport cars, yachts, and antiques without agent.

- Travel the world

Users can book airline tickets, car rentals, airport pick up, and hotels from integrated travel booking agency like Expedia and CheapAir[10]. Also, traveler can cut costs and avoid currency exchange rate risk by using cryptocurrency for the payments. Credit card companies charge 2% to 3% per transaction, yet cryptocurrency payment processors only take 1% fee of every transaction.

7. How can cryptocurrency be exchanged for cash, or transferred to and from regular bank accounts?

For BitCoin (BTC), users required to have a BitCoin wallet for doing transactions with their BitCoin, including buying or sell. BitCoin wallet is very [11] since it is the secure way for users to keep their BitCoin. After users have their BitCoin wallet, there are serval ways for them to exchanged their BitCoin into cash or transferred to and from regular bank accounts, which including through local BitCoin trading site exchange it with persons who accept cash paying or bank deposit, BitCoin Exchange site, and BitCoin ATMs. By website like localbitcoins.com, users could buy and sell their BitCoin with persons in their countries, with flexible payment method such as national Bank Transfer, Alipay, cash, it is fast, easy and private. For BitCoin ATMs[12], users could buy and sell BitCoin with cash only, it is easy and fast, however, BitCoin ATMs are not common is some countries, also the transaction fee is averagely higher than other ways. Lastly, the most secure way is to exchange BitCoin with professional BitCoin Exchange site, like btctrade.com in China, coinbase.com for global and gatecoin.com in Hong Kong. Besides the above general method, there is a special method in Taiwan, with using the BitoEx wallet, Taiwan users could exchange BitCoin for cash in Family Mart by iBon machine, it is a convenient store in Taiwan.

For Dash (Dash), users could sell it and buy through exchange site[13], however to exchanged Dash into cash or transferred to and from regular bank accounts have to first exchange Dash into BitCoin to do transactions. Dash users could through their Dash wallet to do transactions, and for some exchange site they provide directly exchange, for example, AnycoinDirect.eu, users could sell Dash and buy it directly from IBAN bank account with 12 hours. But the disadvantage of this method is the transaction fee will be higher and with a lower exchange rate. Besides, Dash could also exchange in the Teller Machine, but only for 2 companies, TigoCTM and General Bytes. The easiest way is to exchange DASH into BitCoin, then users could have more options to transfer their cryptocurrency by the website like changer.com into BitCoin then exchanged into cash or transfer to their bank account through paypal.com or other channel mentioned above.

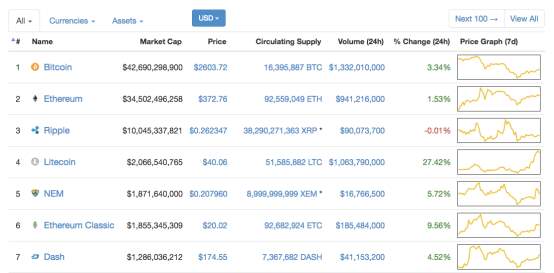

For NEM (XEM), users could buy and sell on exchanges site such as Poloniex, Bittrex and BTC88, who provided the platform for NEM exchange. Through those websites, users could withdraw their NEM directly through bank account[14], in the same time to buy NEM by bank account.

To compare the 3 cryptocurrencies, BitCoin has much more channel for the users to exchange their cryptocurrency into cash, and NEM(XEM) have no way to exchange it into cash. Most of the cryptocurrencies have to through BitCoin to change it into cash since BitCoin is the most well-developed cryptocurrency, and with the longest history in the world.

8. He’s become aware of some recent negative publicity in the press regarding cryptocurrencies, and wants to know if it’s justified, and whether there’s reason to be concerned about investing in any cryptocurrency over the long term, due to the reasons for the bad publicity?

The most concerning problem for most of the investor and countries is the decentralisation of the cryptocurrencies, most of the cryptocurrencies don’t have any central authority, easily to involve in illegal activities, such as WannaCry happen in not long ago. However, decentralisation could ensure there is no any central authority to control the transactions in the market, resulted in the ownership is preserved and protected, everyone could flexible transfer and exchange their cryptocurrencies easily. And without any central bank control, transactions on cryptocurrencies platform could be complete anonymity, the advantage of being anonymous is users could protect their personal information without the concern of privacy being the leak as the nowadays credit card potential crisis. Besides, businesses or merchants could be prevented from unwanted prying into their customer’s or themselves spending habits, to prevent money stolen or impact on credit rating, even the monitoring from the government or national bank, ensure the free market flow. Besides, with decentralisation, the transaction cost is low, since there is no any agency fee and easily transfer on the internet to any person, transferring cryptocurrencies from A to B could free of limitation and handling charge, free of any adverse effect from bank policies and instability.

Second, people always concerned about the security problem of cryptocurrency. Cryptocurrency is a relatively secure currency in nowadays, one of the characteristics of cryptocurrency is they adopt cryptographic algorithm to secure the transactions and to control the creation of additional units of the currency. It is hard to hack by the general hacker into the transactions system. At the same time, take BitCoin as an example, the blockchain is a public ledger that records bitcoin transactions, it is totally transparent. The blockchain is a distributed database, therefore BitCoin transactions are easy to trace, this could prevent certain extent of illegal activities.

With the gradually mature development on cryptocurrencies, the technology in digital currency is being well developed in the following years, and more countries and business start to approve and welcome cryptocurrencies. More merchants will accept cryptocurrencies as a payment method, and more users will come from multiple places like India, China and Africa since cryptocurrencies are not limited by time and region, no transactions barriers like the national bank. Besides, to compare with current dollars, virtual currency as BitCoin, has a low inflation risk, since the system is designed to be finite, the supply growth will be bounded in particular limits.

In order to ensure your cryptocurrencies security, investors should choose an authentic exchange site and cryptocurrency wallet, avoid those fake or low credit platform. Cryptocurrency wallets are basically of two types, the Hot Wallets refers to internet linked wallet and Cold wallets refers to hardware or paper wallet. For cold wallets, they are the highest protection for your cryptocurrencies, they are safe, secure and hack-proof because no one could hack your hardware belongings. Furthermore, every user are encouraged to the backup own wallet to secure their cryptocurrency. The above suggestions could help to eliminate most of the concern to the public.

9. Are there any countries currently that has banned the use of cryptocurrencies by their citizens? If so, you must list these countries.

Yes, they are Bolivia, Ecuador, Kyrgyzstan and Bangladesh[15]. In July 2014, statement of the National Bank of the Kyrgyz Republic made clear that “the use of ‘virtual currency’, bitcoins, in particular, as a means of payment in the Kyrgyz Republic will be a violation of the law of our state.”. In September 2014, Bangladesh Bank said that “anybody caught using the virtual currency could be jailed under the country’s strict anti-money laundering laws”. For Ecuador[16], The National Assembly of Ecuador banned all decentralized cryptocurrencies, due to the establishment of a new state-run electronic money system. Ecuador’s new project would be controlled by the government and tied directly to the local currency—the dollar. Users will be able to pay for select services and send money between individuals. This will begin in mid-February 2015. “Electronic money is designed to operate and support the monetary scheme of dollarization,” economist Diego Martinez, a delegate of the President of the Republic to the Board of Regulation and Monetary and Financial Policy. In 2017, Bolivia[17] lawmakers have enacted a crackdown on cryptocurrency use, arresting 60 people at a workshop and describing it as a “pyramid scheme.” In a statement issued by the country’s Financial System Supervision Authority ASFI, its head Lenny Valdivia Bautista said it was necessary to “remind” the population that virtual currency of any kind is “prohibited.”.

10. Describe countries that illegal the use of cryptocurrencies/ what regulations they have put in place and how to circumvent them?

At present, from a global perspective, the future, the issuance of digital currency is a kind of traditional money, is also a kind of trend, but up to now, most countries have not issued official digital currency. For example, bitcoin, Wright coins, and other existing digital currencies are also published by non-official bodies and companies. Many countries still hesitate on how to regulate bitcoins, as the system is relatively new or is considered an unknown territory. While some countries have banned or restricted their use, many have explicitly allowed bitcoins for trading. While this post provides, information regarding the legality of bitcoin, prohibitions, and regulations that apply to this cryptocurrency extend to all online currencies.

The United States has taken a positive approach towards bitcoin. At the same time, it has several government agencies working on preventing or reducing the use of bitcoin for illegal transactions. Prominent businesses like Dish Network (DISH), Dell, and Overstock.com (OSTK) welcome payment in bitcoin. The digital currency has also made its way to the U.S. derivatives markets, which speaks about its increasingly legitimate presence. The U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) has been issuing guidance on bitcoin since the beginning of 2013. The Treasury has defined Bitcoin not as currency, but as a money services business (MSB). This place it under the Bank Secrecy Act which requires exchanges and payment processors to adhere to certain responsibilities like reporting, registration, and recordkeeping. Also, Bitcoin is categorized as property for taxation purposes by the Internal Revenue Service (IRS).

Although the European Union (EU) has followed the development of the cryptocurrency, no official legitimacy has been issued so far as to decide to accept, or regulate. In the absence of inner guidance, individual EU countries developed their bitcoin stance. Some states allow bitcoins, while other nations either hesitate or warn.

In Finland, the central revenue agency (CBT) classified Bitcoin as a financial service, giving bitcoin value-added tax exemptions. Bitcoin is regarded as a commodity in Finland, not a currency. Belgian Federal Public Service Finance also keeps bitcoins from VAT (VAT). In Cyprus, bitcoin is not regulated or controlled, but it is not illegal. In Britain (UK) the financial authority (FCA) has a pro-bitcoin stance and wants a regulatory environment to support digital currencies. Bitcoin has some tax rules in Britain. The State Taxation Administration (NRA) Bulgaria has also brought bitcoin under existing tax laws. Germany is open compared to the dollar; it is considered legitimate, but tax varies depending on whether the government deals with exchanges, miners, businesses or users

Other countries, mainly Western countries, and North America allow the use of these currencies, and prudent management of their laws and regulations to ensure the legality and security of trade. Their purpose is to regulate the use of taxes, i.e., the capital gains derived from the possession of money. They realized it is hard to prohibit the use, so it would be better to regulate and levy it.

In the United States, the IRS ruled that Bitcoin would be considered the property for tax purposes, making bitcoin subject to capital gains tax. The financial crime Enforcement Network (FinCEN) has issued guidelines for cryptocurrencies. The release guidelines include an important warning for Bitcoin miners: it warns that any creation of bitcoins and the exchange of them as legal currencies are not necessarily beyond the scope of the law. Its state: “A person that creates units of convertible virtual currency and sells those units to another person for real currency or its equivalent is engaged in transmission to another location and is a money transmitter.”

Providing a concrete answer to the question ‘‘are bitcoins legal or not?” is virtually impossible, as there are no parallels and precedents in the legislature of many a country. Although the bitcoin system is more than five years old, many countries still do not have systems that regulate, ban or restrict the cryptocurrency. Overall, Bitcoin remains in the gray as the leap in technology has outweighed the lawmakers by a fair shot.

One thing seems clear, without cryptocurrencies the new and more vibrant and trusted economy would be incomplete. Whereas, as more and more public consciousness of the importance of the new ecosystem is built, the more pressure will there be on governments around the globe to consider cryptocurrencies and bitcoins more seriously. A point will come when there will be those who dwell in the new reality and those that are left out.

For IMF, worried about other risks widely used by cryptocurrencies, the report said, “over time, they will have a serious challenge to the business model segment of the established financial system.”. Cryptocurrencies distributed classification technology will continue to attract policy makers and regulators at the national and international level two, noting the conclusions of the report. The IMF also attacked the block chain smart contract development, saying that they are still in the early stages and many issues need to be addressed, including careful observation, external events, and integration. “Some platforms such as Ethereum and codes for the application of blockchain technology in creative contract execution. A viable, intelligent contract system has not yet appeared.”

11. SWOT Analysis

For Bitcoin

S-Strength

-Fully centralized release model

The issue and circulation of bitcoin are achieved through the open source P2P algorithm. Without an issue, it would not be possible to artificially manipulate the number of bitcoin issues, thereby avoiding potential inflation.

Robustness

-A copycat is hard to survive

Since bitcoin algorithms are fully open source anyone who can download bitcoin source code, and then modify some parameters and names, and then recompiled, you can create a new P2P currency. But these alternative coins are vulnerable and vulnerable to 51% attacks. Any individual or organization who controls the value of currency or currency by manipulating the power of a P2P currency network 51% can be a crushing blow to the P2P currency. A lot of alternative money is dead at this link. And bitcoin network is robust enough to control the bitcoin network 51% of the computing power, and the necessary force resources will be an astronomical figure.

W-Weakness

-The popularity of resistance is larger.

The contrast between the public’s currency and the traditional financial institutions’ resistance to it led to the situation. Active Internet users can easily understand the principles of P2P networks, and know that bitcoin has no legal person for the advantages of manipulation and control. But ordinary citizens do not necessarily understand this difference; many people cannot even distinguish bitcoin and Q coins. Besides, the biggest advantage of the “no issue” bitcoin, which seems to be worthless to some traditional financial practitioners, is rooted in their deep-seated ideas

O- Opportunity

Bitcoin is a cryptocurrency, and it was created in 2009 and has been gathering a strong, thriving pace ever since. Although slow in today’s digital world, it has become the next step in money transfer, online bookings and payments, and exchange by using the digitally signed messages that transfer ownership of Bitcoins. Those digitally signed messages are in the sense addresses that authenticate the payee’s identity for the recipient. Bitcoin transfer allows payments to digitally exchange or transfer without exchange rate fees, which for many a perfect solution for users that are growing by the day. It is a matter of non-allowance of the inordinate amount of taxes to the third party. The appeal of Bitcoin is slowly revealing to Bitcoin opportunists and techno-libertarians around the world. The reason being, it allows you to make digital purchases in stores without revealing your identity, for instance, similar protection by using a credit card with your name and number on it, Bitcoin transfer would let you do the same thing online. With Bitcoin, one can avoid paying high transaction fees, and they don’t have to worry about accounts getting compromised due to hacking or fraudulent results of charge-backs. Additionally, the users are offered discounts to Bitcoin shoppers and with that would make the currency more appealing. Along with such benefits, Bitcoin opportunists are utilizing this digital currency for spending internationally or on foreign and abroad tours where worries about converting the hard or electronic money to the local currency are avoided, and mainly all the conversion fees that go along with the transformation.

T-Threats

-The joint statement was betrayed, and industry discipline was broken

Perhaps many people do not want to admit that, if bitcoin extinction, then undoubtedly this event is the starting point of bitcoin extinction. If there is no self-discipline, then everything is not worth mentioning, and regularly destroy, competition in the industry will form a vicious circle, and eventually lead to irreversible consequences. So far, we have been unable to shake off the shadow of the event.

-Bitcoin financial products

“Financial products” and “bitcoin financial products” are two entirely different concepts. The so-called financial products by commercial banks and financial institutions designed and issued will raise funds to invest following the contract products related to financial market and buy related financial products, and according to the distribution of the settlement, products return to investors. Bitcoin financial products, known to all, is to raise the market by bitcoin short selling behavior. The legitimacy of the act itself is not to be said, and its existence is a great hurt to the bitcoin and all the supporters of Bitcoin

For Dash

S-Strength

The biggest advantage of the world currency is its primary node network. This two-tier network gives it the bits of innovation that bitcoin does not have, enabling it to develop features such as instant messaging, anonymous messaging, and the world dollar budget system.

The second advantage of the world currency is its core team. I don’t think their team is perfect (again, they have their weaknesses, too). However, the team has performed well in innovation and has been very effective. Besides, it reached world currency investment in R & D, and not busy in the social platform, and the silencing of Daz UI zhang poaching and so on. In short, the world’s core team is very professional. For me, this is important because the digital money can be successful in the payment industry only when a professional team establishes a successful company.

W-Weakness

The universal currency has all the problems associated with centralized encryption of digital currency – upgrade. Recently, the world currency has made a dense branching of its network. It is very well in the bifurcation of miners, the master node and merchants have completed the upgrade, do not worry about forking out a new currency (such as the emergence of a “world currency classic”), there is no use out of fear and refused to upgrade bifurcation. However, the update took several weeks to pause and send instant mail. At present, the utilization of the world dollar is still relatively small, so this is not a big problem. But if it wants to be a centralized “Paypal 2” and has millions of users, this slow upgrade process and lengthy disabling capabilities are intolerable

O- Opportunity

Since Dash is a newcomer in the market, the price per coin is meager compared to that of the bitcoin. Therefore, it has higher marketability and more promising growth potential. In this March, the increase in price comes to 100% in just one week, which indicates a very profitable investment.

T-Threats

There are still new entrants into the cryptocurrency market, so the market status of Dash will not be stable. Newcomers may dilute the capital in this market and hinder the growth in price. Some critiques said that the extreme increase of Dash is due to speculation and there are huge bubbles in the high price. Others refer to several pyramids selling scam associated with Dash coin and add to the negative publicity of Dash.

For NEM

S-Strength

The new currency technology is very robust, but also can convince people, compared with other block chain platform, using the new currency platform to build applications have many advantages, it can provide a platform for safety information transmission and value transmission. The new coins are written by professional programmers, to facilitate the use of interface its thoughtful design. With these ports, you can create accounts with multiple signatures in seconds, and send, receive coins and messages. The new built-in multi-signature is a part of the system, and another advantage of the platform is that we can quickly make sure your currency is safe.

Unlike bitcoin, NEM is not a currency. NEM is a movement that creates a whole set of economic ecosystems by NEM. Other NEM like initiatives touted the use of 2.0/2.5 encryption technology. As a financial ecosystem, NEM can provide a medium of exchange far more than a single electronic currency, which can itself serve as a driving force for the functioning of the entire financial ecosystem. In the financial ecosystem, can build a lot of things, including e-commerce, security, and encryption, information applications, social networks, social media, digital asset management, exchange platform or to achieve specific application needs of public accounts management solutions.

W-Weakness

Late foundation. Because of its new foundation in 2014, some fewer people are familiar with it. So, it isn’t as popular as another type of currencies. So, it may lack significant funds to invest and develop it.

-NEM requires diversification. It doesn’t have any other new and attractive companies to support its development. This may also contribute that few people want to trust and buy NEM.

-NEM has some kinds of nodes which may contribute to the centralization in the long term. Because NEM isn’t very mature, there are some bugs in the system. Although it is not a big deal now, it may increase significant problems in the future if NEM doesn’t take serious consideration. In a decentralized NEM system, some centralized nodes may keep buyers away from buying it and limit its development.

O- Opportunity

Thoroughly will launch mobile wallet NEM change the way people work, carry on the two-dimensional code, the information terminal will make everyone regardless of nationality, regardless of the size of the NEM space to enjoy a one-stop economic and information sharing mode. The multi-signature support of mobile wallet will make the management of funds and joint accounts more convenient. NEM users and fund managers will not be able to pay their bills without having to worry about cosigner going out.

Most of the Shanzai coins are changed from bitcoin’s initial block chain model replication, and unlike that, NEM is entirely rewritten based on java8. As a new block chain technology, NEM solves the common problems of other cryptocurrencies (such as mining waste of resources and power centralized). Also, as a widely-supported software development platform, Java will not lack programmer support as a long-term solution

T-Threats

It mainly includes the risk of money laundering and the risks of other crimes. Because the new virtual currency transaction is anonymous, centralized and free of geographical restrictions, it ‘s hard to monitor the flow of funds. It is very suitable for money laundering. The new virtual currency can easily be used indirectly by illegal criminals or organizations and provides funds transfer and transaction convenience for illegal activities

With the development of international financial markets and complex systems, this situation put much pressure on the elaboration of the NEM. Without the doubt, these currencies such as bitcoin also gain the competitive edge over NEM in the market. So, it is hard for NEM to win the competition in the market.

12. What has been the actual % increase in the value of 1 Bitcoin, 1 Dash and 1 NEM, since their start, until the present time?

For Bitcoin

Seven years later, the value of bitcoin grew by 879999 times compared with 2010. If an investor then decided to buy about 2000 bitcoins for $5, the principal would be worth about $4 million 400 thousand today. If the investor had invested about $1200 in some $480 thousand, his net worth would now be at least $1 billion 100 million

For Dash

Its currency has been relatively stable since its release. Earlier, the currency had had a short period of currency appreciation between May 2014 and September; also, the price chart of the world currency had remained relatively stable. The value of the coin climbed from a trough of 1 to 2 dollars at the start, up from $7 to $2016 at the end of 10, with no apparent surge during the period. As a result, the recent rise in the value of the currency has been a precedent in its history.

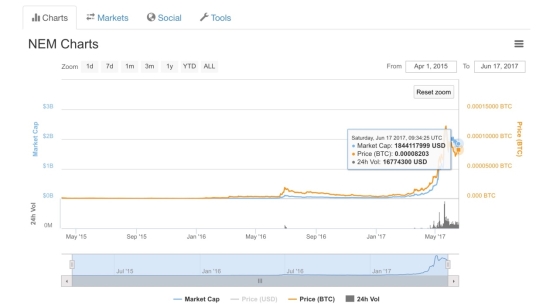

For NEM

The price of the new currency has been trading between 0.0001 and three for the past 0.001 years. As of yesterday’s, press release, its trading price had exceeded $0.23, or more than 77% in 24 hours. The data came from Coinmarketcap, which confirms the growth of a rocket. Most of the growth took place in 2017, and the charts tended to be closer to the vertical than the etheric square and the world dollar.

Recommendation

Bitcoin

Bitcoin is one of the cryptocurrency and it was created in 2009. Cryptocurrency is still a new technology concept and new transaction method for the majority of people. the popularity of resistance is large. And people show limited recognition of cryptocurrency. However, the virtual currency is the trend for the transaction method in the future. There is still huge growing prospective for bitcoin.

Compare with other alternative cryptocurrency, bitcoin has the most mature technique and has the biggest market share. The alternative cryptocurrencies has higher defective rate of their system which is easily to be hacked. As being the leader of cryptocurrency, bitcoin has been utilized widely. Bitcoin started to be accepted by some merchants, consumers can get products or services by bitcoin payment option. People can exchange bitcoin into cash easily through exchange sites and ATMs. At the meanwhile, alternative cryptocurrencies have to exchange to bitcoin first and then use bitcoin to exchange for cash.

The future prospective is positive for bitcoin. The first mover advantage made it occupied largest market share, and being the leading icon for the cryptocurrency market. The pros of bitcoin are secured system, wide implantation, no exchange rate risk, low transaction fee, and no inflation problem. All of these advantages could bring long term growth in the future.

Dash

NEM

Since NEM is still too young, which has only developed three years. Not only the liquidity, but also the security is not enough to be trusted. Also, there is involve 3000 stakeholders and each one can only control 0.025 percent of the currency. Although the decentralization is well, it’s meanwhile hard to predict. As an investment product is hard to predict it future trend, limited history and limited information, it is hard to familiar and good to invest. since it is an new cryptocurrency, it ‘s hard to be exchanged for cash.

The second disadvantage is that it is easily involve crimes such as money laundering. As what I have mentioned before, the technology is still immature, the secured problem is worried. Since the transaction is anonymous, it’s hard to monitor the flow of funds. Government is also consider the risk of crimes in NEM, so the legislation is strict for NEM. once the crime occur, some government may limited the development of NEM in that countries. if we invest it, we will lost a lot.

Bibliography:

www.investopedia.com/terms/b/blockhouse.asp#ixzz4kcGBNis3

www.investopedia.com/terms/b/blocktrade.asp#ixzz4kbxilZ7x

http://igaming.org/cryptocurrencies/section/how-to-buy-cryptocurrencies/

http://cryptosource.org/getting-started/get-coins/

https://medium.com/@nellsonx/how-to-properly-store-bitcoins-and-other-cryptocurrencies-14e0db1910d

https://medium.com/dash-for-newbies/cold-wallet-vs-hot-wallet-whats-the-difference-a00d872aa6b1

https://www.weusecoins.com/en/getting-started/

https://www.entrepreneur.com/article/278745

https://www.weusecoins.com/what-can-you-buy-with-bitcoin/

https://99bitcoins.com/who-accepts-bitcoins-payment-companies-stores-take-bitcoins/

https://www.dash.org/cn/exchanges/

https://sites.google.com/site/lostjob080/zi-xun-sheng-huo-lei/you-zhi-tou-zi-xiang-mu

https://dashpay.atlassian.net/wiki/pages/viewpage.action?pageId=84213798

https://www.cryptocoinsnews.com/top-10-countries-bitcoin-banned/

https://cointelegraph.com/news/bolivia-calls-cryptocurrency-pyramid-scheme-arrests-advocates

http://kingsreview.co.uk/articles/ecuador-bans-bitcoin-a-monetary-mix-up/

https://www.nem.io/faq.html

http://www.coindesk.com/price/

http://coinmarketcap.com/

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this assignment and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal